How do I get a Tax Identification Number (TIN) in Sri Lanka TIN number?

There are two ways to get a TIN number: online or by mail. Here is a step-by-step guide on how to get a TIN number in Sri Lanka:

Online method

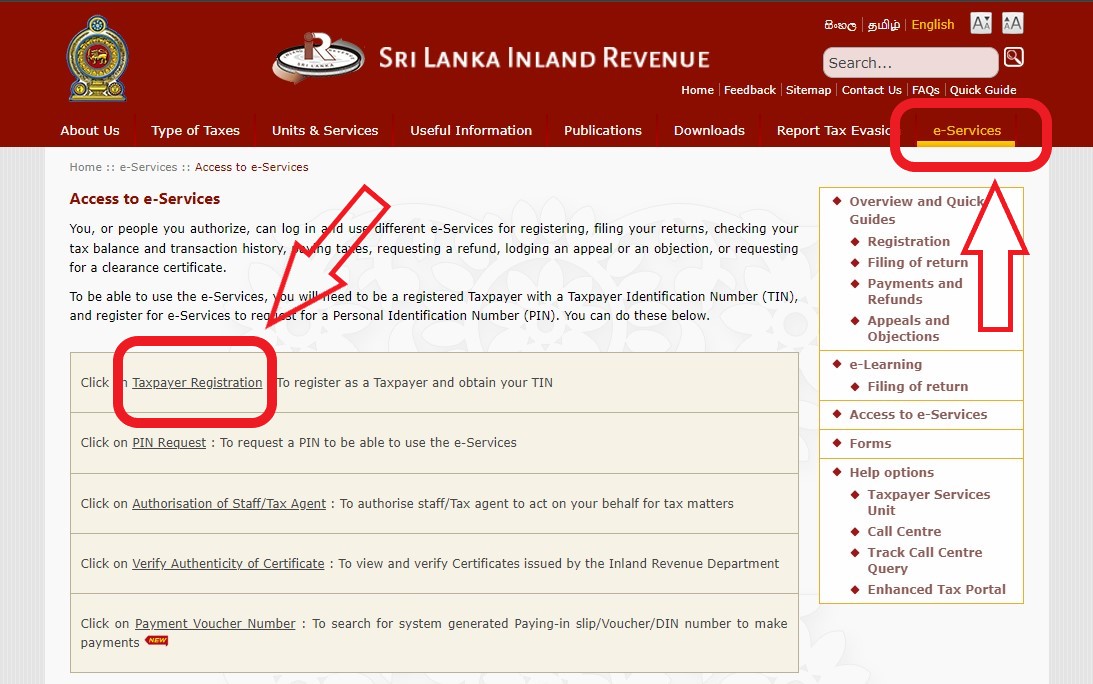

• Visit the IRD website at http://www.ird.gov.lk/ and click on ‘e-Services‘, then ‘Access to e-Services‘, and then ‘Taxpayer Registration‘.

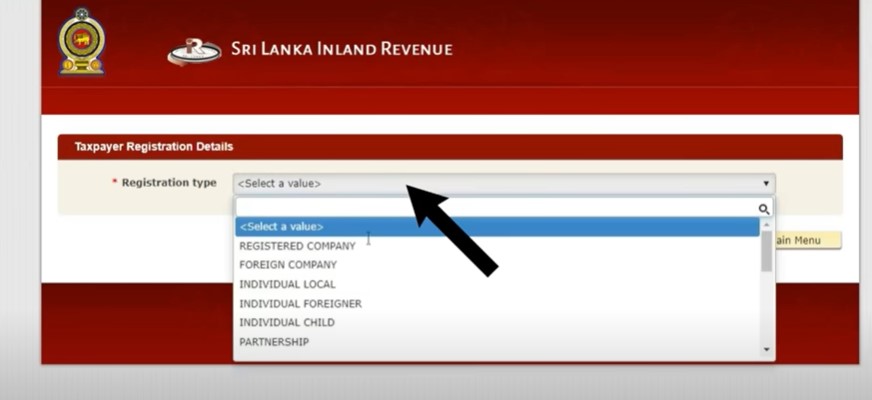

• Choose your category, such as ‘Individual Local‘, ‘Individual Foreign‘, ‘Partnership‘, or ‘Company‘, and fill out the online form with your personal and business details.

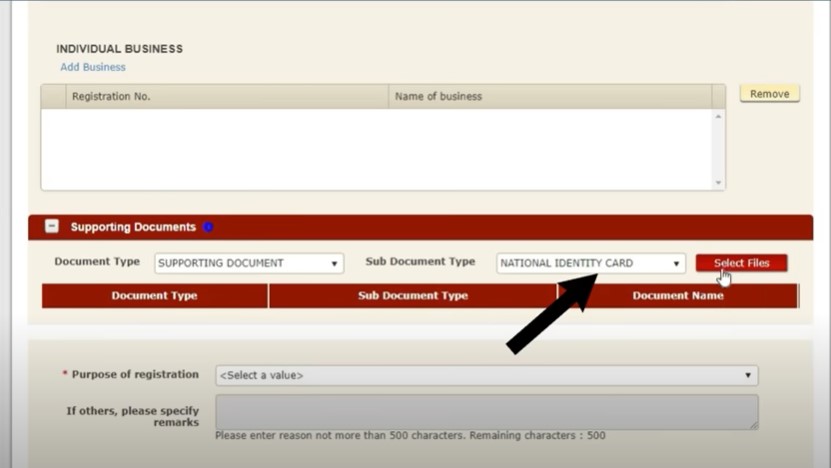

• Upload the scanned copies of the required documents, such as your National Identity Card, passport, business registration certificate, or partnership agreement, depending on your category.

• Submit the online form and wait for an email from the IRD with your TIN number and a one-time PIN to set up your online account.

Mail method

• Obtain the appropriate application form from the Taxpayer Services Unit (TPSU) at the IRD Head Office or download it from the IRD website, http://www.ird.gov.lk/.

• Fill out the application form with your personal and business details and attach the required documents, such as your National Identity Card, passport, business registration certificate, or partnership agreement, depending on your category.

• Send the completed application form and the documents to the following address:

Commissioner General, Inland Revenue Department,

Chittampalam A. Gardiner Mawatha,

Colombo 02.

• Wait for a letter from the IRD with your TIN number and a certificate.

What should I do after getting a TIN number?

After getting a TIN number, you should do the following:

• Activate your online account on the IRD website, https://eservices.ird.gov.lk/Authentication/LoginPersonal using your TIN number and the one-time PIN that you received by email or mail.

• Update your profile and change your password on the IRD website, https://eservices.ird.gov.lk/Authentication/LoginPersonal.

• Keep your TIN number and certificate safe and secure, and do not share them with anyone who is not authorized by the IRD.

• Use your TIN number for all your tax-related transactions and communications with the IRD.

• File your income tax returns and pay your taxes on time and accurately using the IRD website, https://eservices.ird.gov.lk/Authentication/LoginPersonal or other methods.

If you are a Sri Lankan citizen who is 18 years of age or older, you will need to register with the Inland Revenue Department (IRD) and get a Taxpayer Identification Number (TIN) by January 1, 2024. A TIN is a unique number that identifies you as a taxpayer and helps the IRD keep track of your tax obligations and payments.

Why do you need a TIN number?

A TIN number is necessary for several reasons, such as:

• To file your income tax returns and pay your taxes on time and accurately.

• To claim your tax credits, deductions, and exemptions.

• To apply for tax refunds or relief schemes.

• To access the online services and facilities of the IRD, such as e-filing, e-payment, and e-notices.

• To comply with the legal and regulatory requirements and to avoid any penalties or fines that could be imposed by the IRD for not having a TIN number.