To make it easier for taxpayers to pay their taxes, Sri Lanka’s Inland Revenue Department (IRD) and commercial banks launched the Online Tax Payments Platform (OTPP). This in-depth manual provides a clear explanation of the entire process of paying taxes online through OTPP and includes a list of commonly asked questions (FAQs).

Contents

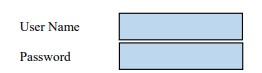

Step 1: Login to Your Bank Portal

To access the online portal of your bank, enter your password and username.

Be aware that different banks may have slightly different interfaces. For detailed instructions on paying taxes to the Inland Revenue Department, get in touch with your bank.

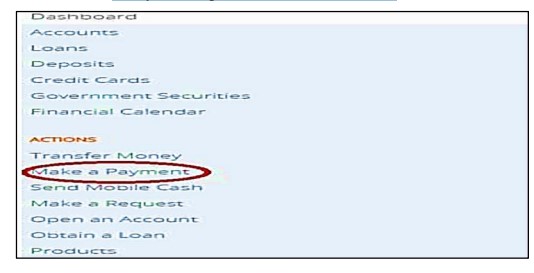

Step 2: Select “Make a Payment” Option

Choose the “Make a Payment” option from the main menu.

Depending on how your bank interfaces, this choice may not be located in the same place.

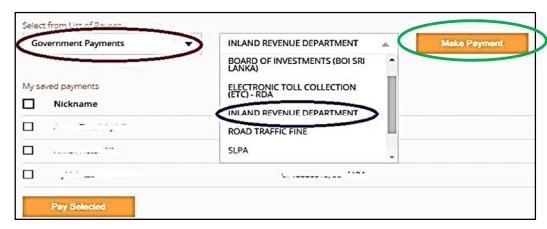

Step 3: Selecting the Payee

Select the “INLAND REVENUE DEPARTMENT” payee from the list.

To continue, click the “Make Payment” button.

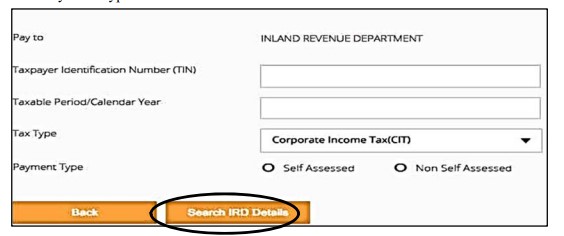

Step 4: Search IRD Details

Enter the following information:

Number for Taxpayer Identification (TIN)

Taxable Time Frame/YearPayment Type and Tax Type

To verify the inputs, click the “Search IRD Details” button.

The system will check the data entered and display the appropriate payment information.

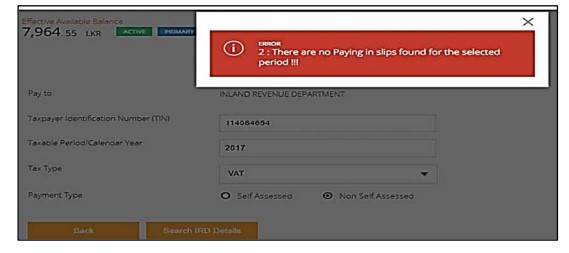

If there is a validation error, an error message will appear.

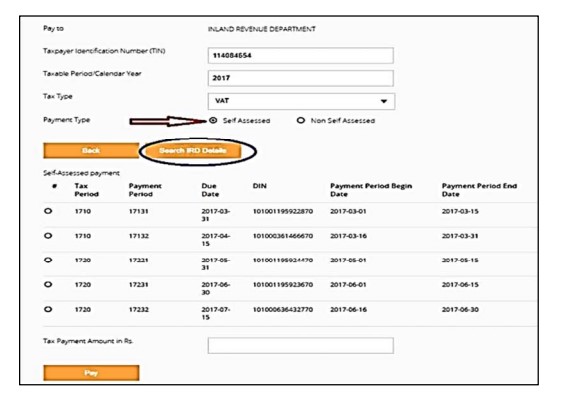

Step 5: Self-Assessed Payment

Select “Non-Self-Assessed payment” for the mode of payment.

Press “Search IRD Details” to see the list of payments.

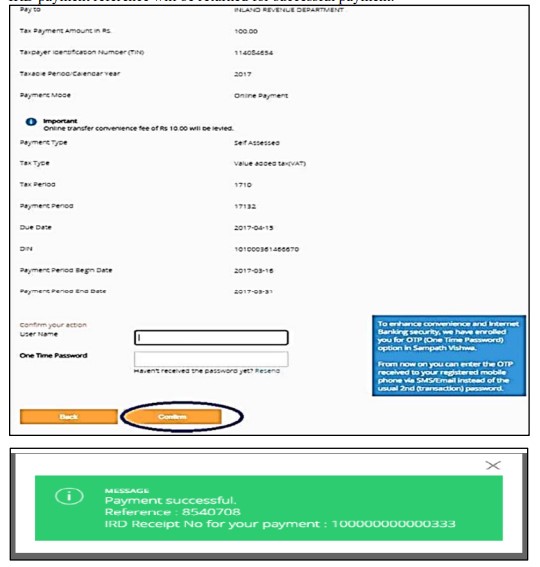

Enter the Tax Payment Amount, Penalty Amount, and Interest Amount after choosing a payment from the list.

To validate the payment, select “Pay.”

Successful transactions will result in the generation of an IRD payment reference.

For further information, you can download the User Guide for Online Tax Payments Platform (OTPP) provided by the Inland Revenue Department.

How to get TIN number Sri Lanka Steps for Tax Identification Number (TIN) in Sri Lanka

FAQs for Online Tax Payments:

- Bank Regulations: Make sure to adhere to your bank’s rules and regulations while making online payments.

- Lanka Clear LPOPP: Fund transfers are handled by Lanka Clear LPOPP, authorized by the Central Bank of Sri Lanka.

- Technical Errors: Any technical faults with your bank’s portal are not the responsibility of IRD. Make payments before the due date to avoid issues.

- SMS Notifications: Register your mobile number with IRD to receive real-time payment notifications via SMS.

- Bank Regulations: Standard bank regulations apply to online tax payments. Contact your bank for more information.

- Payment Date: Payment date is determined based on bank regulations and the time of payment.

- Requesting Online Payment Facility: If your bank doesn’t offer online tax payments, request them to provide the service.

- Discontinuation of ATPS: The Alternative Tax Payment System introduced during emergencies will be discontinued.

Taxpayers in Sri Lanka can use the Online Tax Payments Platform (OTPP) to conveniently and securely pay their taxes online by following these instructions and FAQs. For a hassle-free experience, make sure that bank regulations are followed and keep up to date on payment methods.