Contents

Introduction

When it comes to financial planning, one of the most popular and secure investment options available to individuals in Sri Lanka is Fixed Deposits. These investments offer a reliable way to grow your savings while maintaining a low level of risk. In this comprehensive guide, we’ll delve into the intricacies of Fixed Deposit Rates in Sri Lanka for the year 2023. Whether you’re a seasoned investor or someone considering their first venture into fixed deposits, this article will provide you with valuable insights and information to make informed decisions.

Fixed Deposit Rates in Sri Lanka 2023: Explained

Fixed deposit rates in Sri Lanka for the year 2023 are the predetermined returns offered by financial institutions to individuals who invest their money in fixed deposit accounts. These rates play a pivotal role in attracting investors and influencing their decisions. Here’s a closer look at various aspects related to fixed deposit rates:

Current Scenario of Fixed Deposit Rates

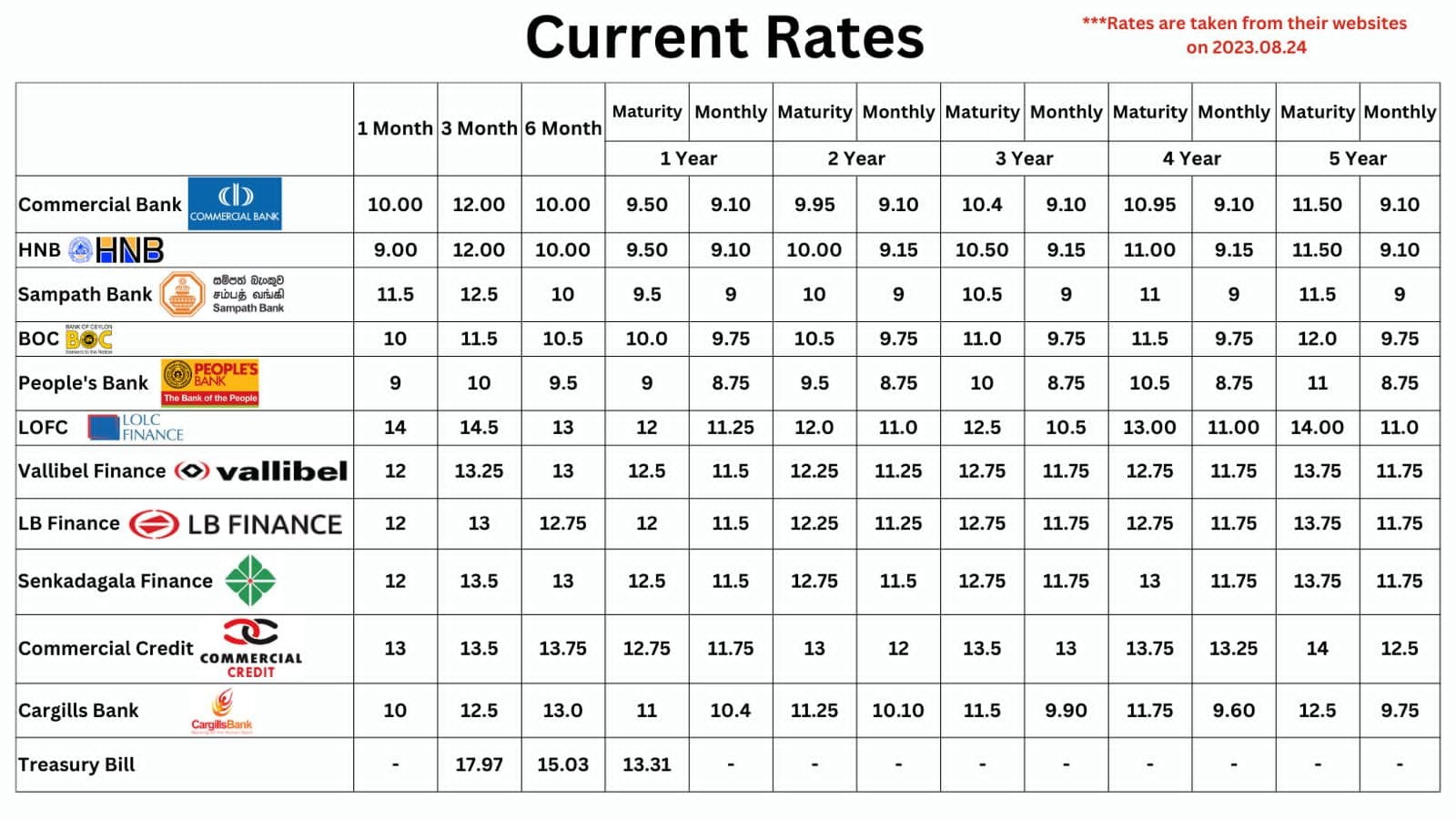

As of 2023, the fixed deposit rates in Sri Lanka have remained relatively stable compared to the previous years. The rates are influenced by several economic factors, including inflation rates, monetary policy, and global economic conditions. It’s crucial to stay updated with the latest rates offered by different banks and financial institutions to make the best investment choices.

New Fixed Deposit Rates in Sri lanka 2023

Fixed Deposit Calculator Sri Lanka

Fixed Deposit Calculator

Factors Influencing Fixed Deposit Rates

- Central Bank Policies: The policies set by the Central Bank of Sri Lanka significantly impact fixed deposit rates. Changes in key policy rates, such as the repo rate, can lead to corresponding changes in fixed deposit rates.

- Economic Conditions: Inflation, economic growth, and currency stability also influence fixed deposit rates. Higher inflation might lead to higher rates to offset the decrease in purchasing power.

- Market Competition: The competitive landscape among banks and financial institutions can result in varying rates. Some institutions might offer slightly higher rates to attract more customers.

Making the Most of Your Fixed Deposits

- Interest Calculation: Fixed deposit rates are typically quoted on an annual basis. Understanding how the interest is calculated and compounded can help you gauge the potential returns accurately.

- Tenure Selection: Different tenures might offer different rates. Longer tenures often come with higher rates. Choose a tenure that aligns with your financial goals.

- Renewal Strategies: When your fixed deposit matures, you have the option to renew it. At this point, you can explore other investment options or negotiate for a better rate with your existing financial institution.

Advantages of Investing in Fixed Deposits

- Low Risk: Fixed deposits are known for their low-risk nature, making them ideal for conservative investors who prioritize capital preservation.

- Steady Returns: With fixed deposit rates being predetermined, you can anticipate the returns on your investment with a high level of certainty.

- Ease of Access: Fixed deposits provide liquidity, allowing you to access your funds without much hassle in case of emergencies.

FAQs

Are Fixed Deposits Safe in Sri Lanka?

Yes, fixed deposits are considered safe in Sri Lanka. They are regulated by the Central Bank and offer a guaranteed return upon maturity.

Can I Withdraw My Fixed Deposit Before Maturity?

Withdrawing a fixed deposit before maturity is possible, but it might come with a penalty. The penalty amount varies based on the financial institution and the terms of the deposit.

How Often Are Interest Payments Made?

Interest payments can vary based on the terms of the deposit. Some institutions offer monthly, quarterly, or annual interest payments, while others provide a lump sum at maturity.

Do I Need to Pay Taxes on Fixed Deposit Returns?

Yes, the interest earned from fixed deposits is subject to income tax in Sri Lanka. The tax rate can vary based on your overall income and tax regulations.

Can Foreign Nationals Invest in Fixed Deposits?

Yes, many banks in Sri Lanka allow foreign nationals to invest in fixed deposits. However, the terms and rates might differ from those offered to residents.

Is It Possible to Open a Joint Fixed Deposit Account?

Yes, most banks allow you to open a joint fixed deposit account. This can be beneficial for individuals looking to invest jointly with a family member or a business partner.

Conclusion

In conclusion, fixed deposit rates in Sri Lanka for 2023 remain a viable investment option for those seeking stability and predictable returns. By understanding the factors that influence these rates and making informed decisions, you can make the most of your investments. Remember to explore the offerings of various banks, consider your financial goals, and align your investment strategy accordingly.

If you’re looking for a secure investment avenue that offers peace of mind and financial growth, fixed deposits in Sri Lanka can be a prudent choice. As you embark on your investment journey, keep in mind the valuable insights shared in this article to navigate the world of fixed deposit rates with confidence.